This article is part of our Football Draft Kit series.

Even with the addition of a 17th game, last season in many ways felt like a return to normalcy for the NFL. Fans were back in the stands after much of 2020 had been played in front of near-empty stadiums, and average attendance was even up a tick (0.9 percent) compared to 2019, pre-pandemic.

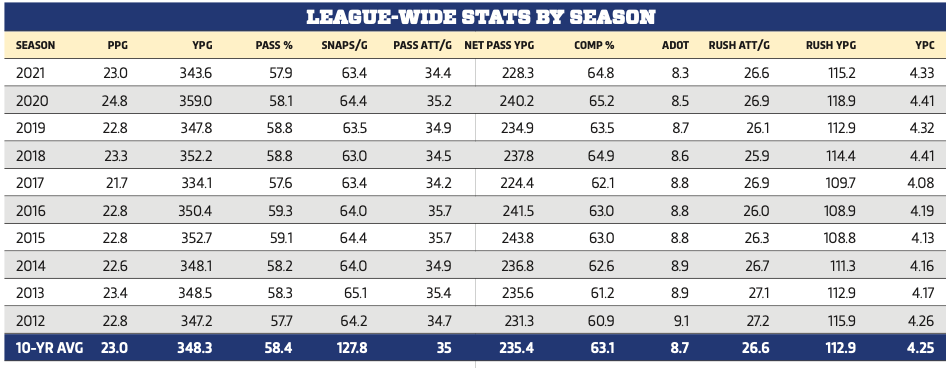

Three games were pushed back on account of COVID-19 outbreaks, but only by two days each — mild chaos compared to 2020 when 15 games were rescheduled and another played with wide receiver Kendall Hinton as Denver's quarterback. The strangeness of 2020 favored offenses, with league-wide averages for scoring and yardage easily hitting all-time highs (24.8 points , 359.0 yards per team game).

Last year, those numbers fell to 23.0 PPG and 343.6 YPG, essentially returning to the 2018-19 level. In other words, it was still one of the highest-scoring seasons in league history, headlined in fantasy by Jonathan Taylor, Cooper Kupp and record-breaking rookie Ja'Marr Chase.

Those three are regulars in the first round of drafts this summer, typically joined by Justin Jefferson, a slew of RBs and maybe Travis Kelce or Davante Adams. In superflex leagues, Josh Allen is right there with them (or ahead) after back-to-back seasons as the fantasy scoring champ at QB.

Allen lost his offensive coordinator to the Giants this offseason, but that's small potatoes compared to another AFC superpower trading Tyreek Hill. The Chiefs weren't alone in their thinking, with the Packers, Titans and

Even with the addition of a 17th game, last season in many ways felt like a return to normalcy for the NFL. Fans were back in the stands after much of 2020 had been played in front of near-empty stadiums, and average attendance was even up a tick (0.9 percent) compared to 2019, pre-pandemic.

Three games were pushed back on account of COVID-19 outbreaks, but only by two days each — mild chaos compared to 2020 when 15 games were rescheduled and another played with wide receiver Kendall Hinton as Denver's quarterback. The strangeness of 2020 favored offenses, with league-wide averages for scoring and yardage easily hitting all-time highs (24.8 points , 359.0 yards per team game).

Last year, those numbers fell to 23.0 PPG and 343.6 YPG, essentially returning to the 2018-19 level. In other words, it was still one of the highest-scoring seasons in league history, headlined in fantasy by Jonathan Taylor, Cooper Kupp and record-breaking rookie Ja'Marr Chase.

Those three are regulars in the first round of drafts this summer, typically joined by Justin Jefferson, a slew of RBs and maybe Travis Kelce or Davante Adams. In superflex leagues, Josh Allen is right there with them (or ahead) after back-to-back seasons as the fantasy scoring champ at QB.

Allen lost his offensive coordinator to the Giants this offseason, but that's small potatoes compared to another AFC superpower trading Tyreek Hill. The Chiefs weren't alone in their thinking, with the Packers, Titans and Ravens also trading 1,000-yard receivers on the cusp of extensions. Between those deals and the ones for QBs Deshaun Watson, Russell Wilson, Matt Ryan and Carson Wentz, it was the busiest offseason in recent memory for high-profile trades.

Last year, the fantasy MVPs both had new QBs, though in Taylor's case it ended up being a footnote. For Kupp, it made a big difference, helping him jump from WR2/3 range to his own tier. There's no guarantee anyone makes a leap that drastic this year, but it doesn't hurt to have so many new QB-WR marriages — a promising recipe for both breakouts and busts … embrace the variance!

Hold on … I Can't Hear You

A de-emphasis of offensive holding played a role in 2020's scoring jump, with refs cutting down by about 35 percent compared to recent years and also flagging offensive pass interference at the lowest rate in eight years and false starts at the lowest rate on record. Each of those three penalties was called more often last season than the year before, but only to an extent — 2021 averages for holding and OPI were second-lowest in the past eight years, up from 2020 but still down by about 13 and 25 percent, respectively, compared to 2017-19.

The return to full stadiums may have helped defenses even more than the return of holding penalties, with passing numbers on the road taking a big step back in 2021 after the odd 2020 season in which QB road numbers were actually slightly better than home stats. The rebound in false starts likely entails some impact from crowd noise, and there was also a 14-year high for delay-of-game calls (.59 per game, up from .46 in 2020).

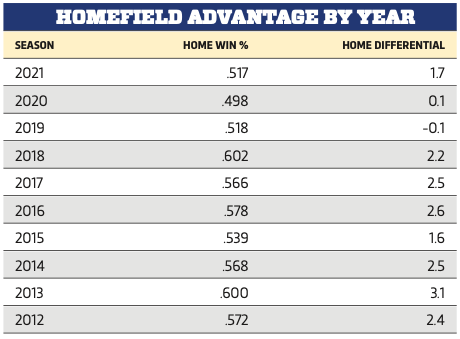

While the return of fans had an impact, home-field advantage still wasn't worth as much as it once was — a trend that predates the pandemic and has been especially noticeable the last three seasons. In fact, the last three years were the three worst since 1972 for home-team winning percentage (.518 in 2019, .498 in 2020, .517 in 2021). Anecdotal explanations for homefield advantage "disappearing" may be logical, but they mostly explain a slow trend since the late '90s, not what happened the last three years. Travel accommodations and sports science didn't improve overnight, nor did standards for locker rooms and playing surfaces.

We also can't point to refs, who still penalize road teams about three yards per game more, with last year's differential (3.2 YPG) nearly identical to the 20-year average. There isn't much evidence of officiating becoming more favorable to visitors … at least not since the late '90s/early aughts when the addition of challenges coincided with the end of a highly favorable era for home teams.

Part of the explanation is that home-field advantage isn't really dead. Hosts won only 51.7 percent of games last year, but they outscored visitors by 1.7 points per game, which was closer to numbers from 2016-18 (2.4 PPG) than those from 2019 (-0.1) or 2020 (0.1). Should home teams outscore visitors by 1.7 points again, it'll likely correspond with a much higher win rate than .517.

On the other hand, it's possible home-field advantage is only worth a point or so nowadays, as we still need to put some weight on 2019 and 2020, especially considering the former season was played under normal conditions. Also consider that home/road differential would've been just 1.0 PPG last year if not for a ridiculous Week 17 with the third highest home-team scoring average of the past decade (29.3) and the second lowest road-team average (16.3).

Regardless of how this plays out in coming years, there's a fantasy advantage to be had if some people still think home field is worth about three points. If we value it closer to 1.0 or 1.5, we're talking about home vs. road being a mere tiebreaker in start/sit decisions. Betting odds increasingly reflect this, with home teams favored by an average of 1.1 points in 2020 and 1.7 in 2021.

Declining aDOT & 2-High Defenses

NFL passing games were less efficient last season than in 2020, especially away from home, but it wasn't reflected in completion rates because teams were attempting shorter passes on average. Even with the drop back to pre-2020 scoring levels, league-wide completion percentage barely dipped, with 64.8 being third best all-time and not far behind the record of 65.2 from the year before.

Average target depth (aDOT) dropped to 8.3 and yards per completion to 11.0, both record lows for a second straight year. Of course, NFL teams swapping out run plays and deep passes for more short throws isn't exactly a recent trend, unless you're old enough that Bill Walsh's Cincinnati years seem recent. Even on a smaller scale, the downward trend in aDOT has been going on for a decade, declining from old norms around 9.0.

Despite the long-term trends favoring shorter passes (and more yards per carry), discussion of "two-high" defenses was all the rage last year, often in relation to Patrick Mahomes. A few teams, including Baltimore and Buffalo, showed Mahomes a ton of these looks with two deep safeties — often intended to limit big plays — and came away victorious in the first half of the season. He adjusted, as you might remember, later putting up 447 total yards and four TDs in a playoff win where the Bills used two-deep looks 92 percent of the time.

That's probably to be expected, given that these coverages are far from a new thing. In fact, the most popular two-high look is Cover 2, a simple zone known as the foundation of quality defenses in Chicago, Tampa Bay and other NFL locales for years. It's part of every NFL playbook, and most pro QBs have been seeing some version of Cover 2 at least occasionally since high school.

Against Mahomes, it's not hard to see why you'd emphasize coverages intended to limit long passes and chunk gains — he likes to throw downfield, and he's darn good at it. On a league-wide basis, the thinking is less obvious, with some trends suggesting defenses should be more worried about short passes.

A lot of it leads us toward "chicken and the egg" logic; for example, when noticing how completion rates on deep throws (20-plus yards downfield) have gone up over time, with 2020 (37.8 percent) and 2021 (37.0 percent) being the best marks on record. Are offenses completing a higher percentage of their deep passes because they're forcing defenses to pay more attention to hitches and slants? Or are they throwing short because defenses are being cautious in response to improved efficiency on deep passes? Or, is at all just a matter of QBs becoming more accurate over time and NFL officiating favoring offenses?

Overzealous enforcement of defensive PI doesn't hurt, and between that and the improved downfield completion rates in recent years, it seems a lot of teams would be well-served by going deep more often. That doesn't mean they will, especially if the defensive trends from 2021 carry over.

4th Downs & 2-Point Tries

It's only a matter of time before a team with a good offense (or bad kicker) makes a habit of going for two. When that happens, the QB and his teammates should make fantasy owners happy, tacking on two easy points here and there.

For now, the so-called analytics revolution seems incremental, which some might say means it's not a revolution at all. Semantics aside, the number of fourth-down and two-point attempts both hit record highs for a second straight year in 2021, now up by about 50 percent compared to even five years ago.

For the dedicated fantasy manager, it's worth keeping track of which teams tend to be more aggressive, especially on fourth down. Going for it more often means fewer kicks/punts and more opportunities for skill-position players. Trading punts for fourth-down tries is good for over bettors and fans of shootouts, regardless of whether they're converted successfully.

Teams and coaches can change their philosophies from year to year, but it's reasonable to estimate that players under Brandon Staley and Kliff Kingsbury will have a few extra chances to extend drives where Sean McVay, Kyle Shanahan, Mike Tomlin or Pete Carroll would kick/punt. Staley and Kingsbury ranked 1-2 in Football Outsiders' "Aggressiveness Index" last year, while McVay, Shanahan, Carroll and Tomlin all finished 20th or lower each of the last three years.

Other frequent flyers atop of the AI ranks include John Harbaugh, Doug Pederson, Matt LaFleur and Kevin Stefanski, with the last two and Kingsbury ranking top 5 in 2020 and 2021. Just remember, Pederson's strategy from Philadelphia doesn't automatically apply to Jacksonville, and others are capable of change as well (Harbaugh, for example, fell to middle of the pack in fourth-down aggressiveness last year with an injury-marred offense).

This small consideration for offensive players is a bigger deal for kickers, who can miss out on ~10 percent of their volume if their coach goes for fourth down inside field-goal range three or four times per year in spots where many wouldn't. The quality of a team's offense matters more, but the fourth-down stuff is worth considering if you're still awake for the final round of your draft.

Cooper Kupp and the MegaWR1

Cooper Kupp's massive 2021 leaves us with the task of finding the next Kupp.

Each of the last three NFL seasons featured a MegaWR1 (trademark pending) who outscored everyone at the position by at least 3.7 PPR points per game. Maybe that's a fluke – before 2019 it'd been 12 years (Randy Moss, 2007) since any WR was even 3.0 ppg ahead of all competion – but it's also possible some of the changes over time have made these huge seasons possible or increased the likelihood, especially under PPR scoring.

Moss' historic year was based on long gains and TDs, while our MegaWR1s the past three years (Kupp, Davante Adams, Michael Thomas) got it done with massive volume and catch rates above 75 percent. Kupp and Adams also had plenty of splash plays to go with the onslaught of short catches, but Thomas really didn't (seven TDs, three gains of 40-plus yards).

What all three had in common, apart from talent, was quality QB play, an efficient offense and target shares well above 30 percent (31.7 for Kupp, 33.9 for Adams, 33.2 for Thomas). None of which is groundbreaking, but it can still be a useful framework for thinking about upside at wide receiver.

Other fantasy players often look for the same traits, which explains why CeeDee Lamb and Tyreek Hill have similar ADPs this summer after the latter did way more the last two years. Lamb is a better fantasy pick, all the same, in large part because he offers some slim shot of that Kupp/Adams-type season. Downside/floor matters too, but the idea of Hill as a super-secure pick no longer checks out, in any case, after he changed teams and downgraded at QB.

The 2021 Rams, 2020 Packers and 2019 Saints ranked 10th or lower in pass attempts, so the hunt for our next MegaWR1 need not be restricted to pass-happy offenses. It might feel like sacrificing upside to pick Justin Jefferson over a running back in Round 1, until we consider that his ceiling might look more like Kupp's 2021 than his own.

Jefferson turned 23 this summer, and he already has one season with a catch rate higher than 70 percent and another with a target share just a tick less than 30 (29.4 percent last year). Maybe former Rams OC Kevin O'Connell can help Captain Kirk take JJ to the Kupp galaxy.

Another possibility is that this year's own-tier-at-his-position guy won't be a wide receiver. TE Travis Kelce joined Adams in doing it in 2020, averaging 3.5 more PPR points than Darren Waller. In 2019, the aforementioned Thomas was joined by Lamar Jackson at QB (6.3 PPG clear of the field), and Christian McCaffrey at RB (8.5 ahead of Dalvin Cook).

Jonathan Taylor is an obvious candidate, as only Austin Ekeler was in his stratosphere at RB last year after Derrick Henry got hurt (Henry technically averaged more points per game than both). Acquiring Taylor now requires the No. 1 overall pick, while Henry offers similar upside (but also more injury/age risk) a few slots later.

At tight end, offseason events give Kelce, Mark Andrews and Kyle Pitts a chance to reach rare territory for target share. The first two already have individual seasons at 26 percent — about as high as anyone's gone since Tony Gonzalez's KC days — and both saw their teams trade their No. 1 wideouts.

The potential problem is seeing more attention from defenses, and in Andrews' case (and arguably Pitts') a series of offseason moves that hint at more emphasis on the run game. Kelce, per usual, seems to have both the highest floor and ceiling, with the caveat that each passing year after a player's mid-to-late 20s comes with increased risk of a major drop off.

That's far from the worst problem to have, and relative stability around him probably favors a tapered decline phase rather than a drastic one, unless a major injury is the impetus.

Busy Offseason

Five of RotoWire's top-50 players for 2022 are veterans that switched teams in the offseason. Which might not sound like a lot, but the number was four in 2020 and one in 2019. And it doesn't include Russell Wilson, JuJu Smith-Schuster, Deshaun Watson or Allen Robinson (all outside our top 50), nor does it include guys like Jerry Jeudy, Darnell Mooney and DK Metcalf who saw huge changes in context due to losing/adding teammates and/or coaches.

On average, fantasy-relevant players who change teams tend to underperform compared to fantasy-relevant guys who stayed on the same team, but not to an extent that justifies a blanket rule. You could even argue the three biggest trade acquisitions the last two years were DeAndre Hopkins, Matthew Stafford and Stefon Diggs — all good fantasy picks in the first year with their new teams.

For Stafford, the upgrade in situation/context was obvious. For Hopkins and Diggs … less so, funny as that might sound now that Josh Allen has eclipsed Kirk Cousins. Still, the larger history of wide receivers changing teams suggests we should be cautious, especially in cases where the QB downgrade is undeniable (Tyreek Hill, Davante Adams).

Some of you, especially those who play dynasty, will be familiar with the idea that it's a good thing to increase variance for an asset without much value. Christian Kirk, for example, has never quite done enough to be a weekly fantasy starter outside deep leagues. So while a move to Jacksonville typically doesn't do great things for a player's career, Kirk the fantasy asset is probably better off getting out of Arizona anyway, if only because the slim chance for a boom is more meaningful than the larger chance for a bust when you're mostly drafted as a fantasy backup or fringe starter anyway.

The toughest cases are those like Courtland Sutton, whose QB upgrade comes with hype and an ADP rise, even after his disappearing act last November/December. Guys often rebound Year 2 after an ACL injury, but even so, there's reason to think Denver's No. 1 WR will be Jerry Jeudy, who is three and a half years younger than Sutton and was a better prospect and earlier draft pick.

In addition to pondering Jeudy vs. Sutton, we'll have to figure out if the flurry of high-profile trades this offseason was an aberration or the start of a trend. Maybe teams are trying to copy the Rams' success trading for name-brand veterans, or perhaps this last offseason was just making up for lost time after COVID-19 had a major negative impact on the 2021 free-agent class.

Another possibility is that some teams are being more aggressive in taking on future commitments with the salary cap up 14 percent over 2021 ($182.5 million to $208.2 million) and expected to rise another 8 percent or so next year (and the year after). It looks like the cap limit for 2023-24 won't be too far off from pre-pandemic projections, even after the nosedive in 2020-21.

Getting Back to Normal

Looking at stats from last year, you might notice that an unusual number of players missed exactly one game. Some of those guys had a minor injury, but a lot were COVID-19 absences — something that should be way less of a factor this season after the NFL and NFLPA agreed in March to suspend all protocols related to the virus.

We can expect fewer missed games this season, which favors upside over security when filling out bench spots on draft/auction day. COVID-19 was responsible for 15 percent of the total for Football Outsiders' Adjusted Games Lost (AGL) metric in 2020, and then 8 percent last season (with the decrease mostly due to fewer preseason opt-outs, while absences for fantasy-relevant players actually were about the same).

There will still be absences due to the virus here and there — plus the usual assortment of injuries — and it remains to be seen how the move to a longer schedule impacts injury rates over time as each season requires slightly more from each player. NFL chief medical officer Dr. Allen Sills reported no increase for overall injury rates or late-season injury rates in the first year of the 17-game schedule, though there was some uptick in concussions on special teams (a focus in the past) and hamstring and abdomen injuries early in training camp.

Add it to the list of trends we'll need to keep an eye on this year, and remember that math often favors the bold even when fortune doesn't.

This article appears in the 2022 RotoWire Fantasy Football magazine. Order the magazine now.